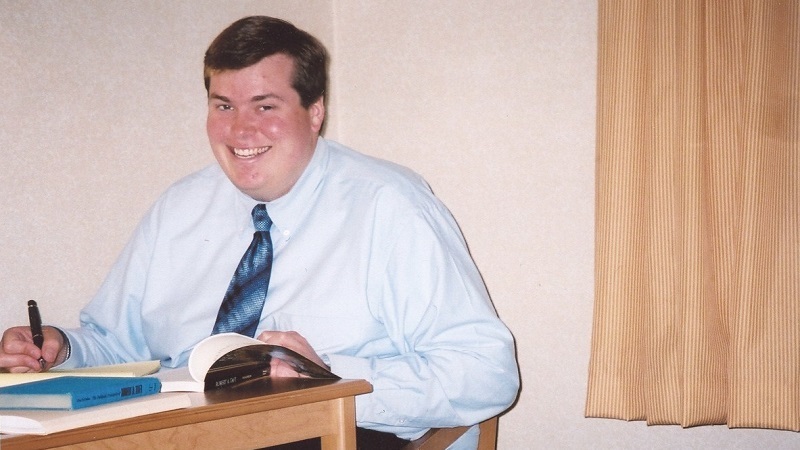

Iowans for Tax Relief Foundation policy director John Hendrickson. | Submitted

Iowans for Tax Relief Foundation policy director John Hendrickson. | Submitted

The state of Iowa is awash in cash, with a surplus that calls for tax relief for residents of the Hawkeye State. That’s the view of Iowans for Tax Relief Foundation policy director John Hendrickson, and he is calling on state leaders to do that during the 2022 legislative session.

“In 2011, the Legislature created the Taxpayer Trust Fund, which was enacted to capture excess revenues to be used for income tax relief,” Hendrickson told Hawkeye Reporter. “In 2018, as a result of the comprehensive tax reform law passed, the Taxpayer Trust Fund was renamed the Taxpayer Relief Fund. Under the Taxpayers Trust Fund excess revenues would be returned to taxpayers through their state income tax returns. Now the Legislature is tasked with returning the money in the Taxpayer Relief Fund back to Iowa taxpayers.”

In a Dec. 1 article for The Iowa Torch, Hendrickson said prudent decision-making led to this moment. It’s a time to seize the day and enact real tax reform, he wrote.

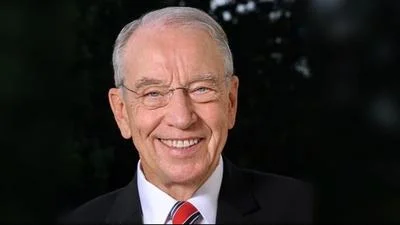

Iowa Gov. Kim Reynolds

| governor.iowa.gov

“Several years of budgeting restraint and booming tax receipts have delivered large surpluses to Iowa, including this past year, when our general fund finished with a $1.24 billion budget surplus,” Hendrickson wrote “Gov. Kim Reynolds and Republican legislative leaders are stating that tax reform will be a priority for the 2022 legislative session. Lawmakers have yet to publicly release any tax reform proposals, but the large surplus presents a historic opportunity to return the money back to taxpayers through substantial and permanent rate reductions, rather than a through one-time credit or cash payout.”

He told Hawkeye Reporter the money is at hand.

“The Taxpayer Relief Fund has a $1.1 billion balance. This creates a historic opportunity for policymakers to pass a comprehensive tax reform measure that lowers both the individual and corporate income tax rates,” Hendrickson said. “The reason for this large balance is the prudent fiscal policies of Gov. Kim Reynolds and the Republican-led Legislature.”

He said there are other elements. But Reynolds, elected to a full term in 2018 after serving out the remaining term of longtime Gov. Terry Branstad when he resigned in May 2017 to become ambassador to China, has shown her willingness to put taxpayers’ needs first.

“It is true that federal pandemic stimulus measures that started with President Donald Trump, especially direct stimulus payments and PPP loans to small businesses, helped the economy, but it was also the actions of Gov. Reynolds keeping Iowa's economy open during the pandemic,” Hendrickson said. “Gov. Reynolds did not shut down the economy and take draconian measures as some other states have done and as a result, Iowa’s economy was able to recover quickly from the pandemic.”

The $1.1 billion balance in the Taxpayer Relief Fund will make tax reform a top issue in the 2022 legislative session, he said.

“Both Gov. Reynolds and Republican legislative leaders have stated that tax reform is a priority,” Hendrickson said. “The Taxpayer Relief Fund will provide an opportunity for the legislature to not only reduce tax rates, but also create a tax reform plan that continues to reduce rates. Gov. Reynolds and Republican legislative leaders understand that Iowa is in competition with other states and a more competitive tax code is needed in order for Iowa not to fall behind. 2022 should be a gold standard tax reform year for Iowa.”

In his essay, Hendrickson said this is a time for action.

“Iowa has a tremendous opportunity to enact pro-growth tax reform that will make our state more attractive to businesses and individuals,” he said. “In our competitive, global economy, tax rates matter. This year alone, Iowa was one of 15 states that passed income tax reforms. If Iowa’s leaders don’t continue to make progress in reducing our rates and making Iowa more competitive, other states will likely pass us by. Gov. Reynolds and the Iowa Legislature should carry on the good work they’ve begun and map out a path to continued rate reductions.”

Iowa's population grew by more than 144,000 residents between 2010 and 2020, according to census figures, a gain of 4.73%. Nationally, the population grew by 7.35%.

Hendrickson told Hawkeye Reporter there were other smart choices made that contributed to this sound economic state.

“Gov. Reynolds and the Republican-led Legislature also kept spending under control and cut tax rates, which created a stronger economy,” Hendrickson said. “Before the COVID-19 pandemic Iowa's economy and fiscal house were in strong order, and it was a result of conservative budgeting and lowering tax rates. In January 2022, the Legislature will reconvene and start the session with a $1.24 billion surplus. This is a result of the conservative budgeting of Gov. Reynolds and the Legislature.”

Hendrickson said there are available lessons from this experience.

“Other states can learn from Gov. Reynolds and our legislature that the key to economic growth and creating a strong financial foundation is following a policy of fiscal conservatism,” he said. “Conservative budgeting and lowering tax rates are essential to a strong economy."

Alerts Sign-up

Alerts Sign-up