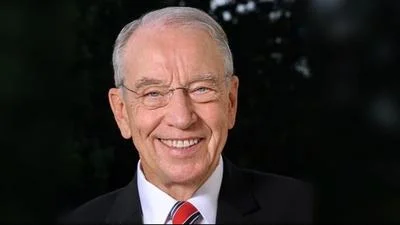

Rep. Gary Mohr supports plan to exempt retirement income from taxation. | Pexels

Rep. Gary Mohr supports plan to exempt retirement income from taxation. | Pexels

Iowa state Rep. Gary Mohr believes he has enough votes to pass his bill House File 2026 in the Iowa House of Representatives. He believes the bill to be popular. The plan is for the bill to go into force retroactively, applying to the new year so far.

Mohr said that he has 54 co-sponsors with him for the bill.

"We have far too many Iowans leaving the state of Iowa, changing their state of residence to states that have no income tax," Mohr said in a video posted to Facebook on Jan. 24.

The plan is for the bill to exempt all retirement income from Iowa's individual income tax. The bill will start retroactively on Jan. 1, 2022, applying to any tax years starting at that date or later. The text of the bill says that it will also apply to nonresidents of the state of Iowa.

Certain kinds of retirement pay from the federal government, such as for military service or disabilities, is already not taxed in the state of Iowa. In addition to simply not taxing retirement income, retirement income in Iowa will not be included into the calculation of whether a person is eligible to pay taxes at all. In the bill, retirement pay is defined as defined benefit or defined contribution plans, annuities, individual retirement accounts, plans maintained or contributed to by an employer, or maintained or contributed to by a self-employed person, an employer and deferred compensation plans or any earnings attributable to the deferred compensation plans.

Whether a married person is filing a joint or separate return is also not relevant to the impact of the bill. This tax benefit will not be received by a person who is claimed as a dependent by another individual for tax purposes.

Alerts Sign-up

Alerts Sign-up