The publication is reproduced in full below:

Tax Day

Mr. THUNE. Mr. President, today is Tax Day, and I think it is probably fair to say it is not most Americans' most favorite day. No one enjoys writing a check to the IRS or contemplating just how much of his or her yearly earnings goes to the Federal Government, especially when the Federal Government doesn't always make the best use of taxpayer dollars.

If you have a question for the IRS, things can get even more grim. The IRS does not exactly have a reputation for excellent customer service. During fiscal year 2021, the Agency answered just 11 percent of the 282 million calls it received--11 percent. That means that 250 million taxpayer calls went unanswered--250 million. And 2022 was barely better. During fiscal year 2022, 87 percent of taxpayer calls--

87 percent--went unanswered. Any business with a customer service record like that would soon be out of business.

That is not even the worst of it. On top of its customer service problems, the IRS has a troubling record of mishandling taxpayer data. Everyone remembers the infamous targeting of conservative groups for extra scrutiny under the Obama IRS. Then there was the 2021 leak or hack of confidential taxpayer information that ended up in the hands of the left-leaning organization ProPublica and was used to advance a partisan agenda. Last September, the IRS reported that it had inadvertently posted confidential taxpayer data for around 120,000 individuals on its website. Then, after fixing its mistake, the IRS inadvertently made much of that same information public again just 2 months later.

It is no surprise that interacting with the IRS doesn't exactly inspire confidence. Given the IRS's record, you would think everyone could agree the Agency is ripe for reform. Democrats, however, apparently thought the Agency was simply ripe for more funding, a lot more funding--funding targeted not toward reforming taxpayer services but overwhelmingly toward increasing tax enforcement.

The so-called Inflation Reduction Act Democrats passed last August contained a staggering $80 billion for the IRS. Just 4 percent of that funding--4 percent out of $80 billion--was earmarked for improving taxpayer services. More than half, roughly $46 billion, was earmarked for increased audits and other tax collection efforts.

But that is not all. President Biden is now proposing to boost the IRS's budget by 15 percent next year--over and above the massive funding boost the IRS already received from the Inflation Reduction Act. And it doesn't even end there. The President's budget would also provide a separate and additional $29 billion to the IRS for enforcement--again, in addition to the $46 billion for enforcement the IRS received last August.

I don't need to tell anyone that President Biden's campaign to flood the IRS with unprecedented funding is motivated not by a desire to improve the Agency's performance but by a need to find money to help offset some of the cost of Democrats' Green New Deal schemes and other big-government spending.

There is reason to be concerned about where the President will be getting all this money he expects to collect. The IRS has pledged not to use its increased funding to raise audit rates on small businesses and households making under $400,000 a year ``relative to historic levels.'' But not only is it not clear what the Agency means by

``historic levels,'' there is also nothing to prevent the Biden IRS from going back on that commitment--if, for example, the President finds he can't pay for his Green New Deal schemes just by increasing audits of higher earning taxpayers.

Suddenly and dramatically increasing the size of any government Agency is a cause for concern. Are there plans in place to make sure the money is used wisely, efficiently? Can the Agency in question handle such a swift expansion? These are serious questions no matter what Agency we are talking about, but these questions are particularly relevant when the Agency in question--in this case, the IRS--is already doing a poor job of handling its basic responsibilities.

Any funding infusion like the $80 billion the IRS received in August should be paired with commensurate oversight measures, including a requirement for a comprehensive strategy and effective execution from the IRS and appropriate safeguards and accountability for taxpayers. But that, interestingly enough, is something Democrats failed to include in their legislation, and they have shown little interest in IRS oversight since.

That cannot continue.

We need to put safeguards in place to ensure that the tens of billions of dollars Democrats have funneled to the IRS are being used responsibly and efficiently and that the IRS is not mismanaging its tax collection powers.

The National Taxpayer Advocate has noted that the money from the so-

called Inflation Reduction Act has been ``disproportionately allocated for enforcement activities and should be reallocated to achieve a better balance with taxpayer service needs and IT modernization.''

``We need to put taxpayers first,'' the advocate said, and she is right. But, unfortunately, Democrats' priority is not taxpayers; it is tax collection.

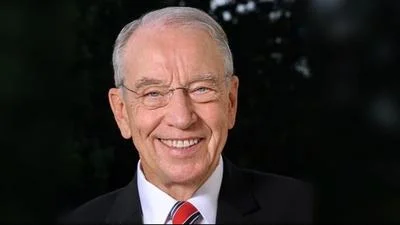

Earlier this year, I introduced legislation along with Senator Chuck Grassley, cosponsored by all Senate Finance Committee Republicans, to improve oversight and hold the IRS accountable for its spending decisions. Our legislation, the IRS Funding Accountability Act, would require the IRS to provide Congress with an annual plan for how the Agency intends to use its new funding--a plan that could be rejected by Congress with a joint resolution of disapproval.

The IRS would also be required to provide Congress with quarterly updates on implementation of the spending plans, and there would be real consequences for failing to submit plans and reports on time, including the rescission of funds until the IRS complies with reporting requirements.

The IRS did recently release an underwhelming report on how it intends to spend its funding windfall, but the report, which was submitted more than 45 days late, was exceptionally vague and short on important details. Our legislation would require the IRS to put forward detailed plans on time and ensure that Congress has the ability to prevent misuse of funds or violations of taxpayer receipts. And I would hope that my Democrat colleagues would recognize the need for this kind of commonsense legislation.

Any massive funding infusion to a Federal Agency needs to be accompanied by meaningful oversight to protect taxpayer dollars and doubly so when it comes to an Agency like the IRS with a track record for poor customer service and mishandling Americans' priority information. As we move forward, I will continue to do everything I can to push for accountability at the IRS to make sure that taxpayers' rights are respected and that Americans' tax dollars are being used responsibly.

I yield the floor.

I suggest the absence of a quorum.

The ACTING PRESIDENT pro tempore. The clerk will call the roll.

The senior assistant legislative clerk proceeded to call the roll.

Mr. DURBIN. Mr. President, I ask unanimous consent that the order for the quorum call be rescinded.

The PRESIDING OFFICER (Mr. Padilla). Without objection, it is so ordered.

Mr. DURBIN. Mr. President, I ask unanimous consent to speak and complete my remarks before the rollcall starts.

The PRESIDING OFFICER. Also without objection.

SOURCE: Congressional Record Vol. 169, No. 64

The Congressional Record is a unique source of public documentation. It started in 1873, documenting nearly all the major and minor policies being discussed and debated.

Senators' salaries are historically higher than the median US income.

Alerts Sign-up

Alerts Sign-up