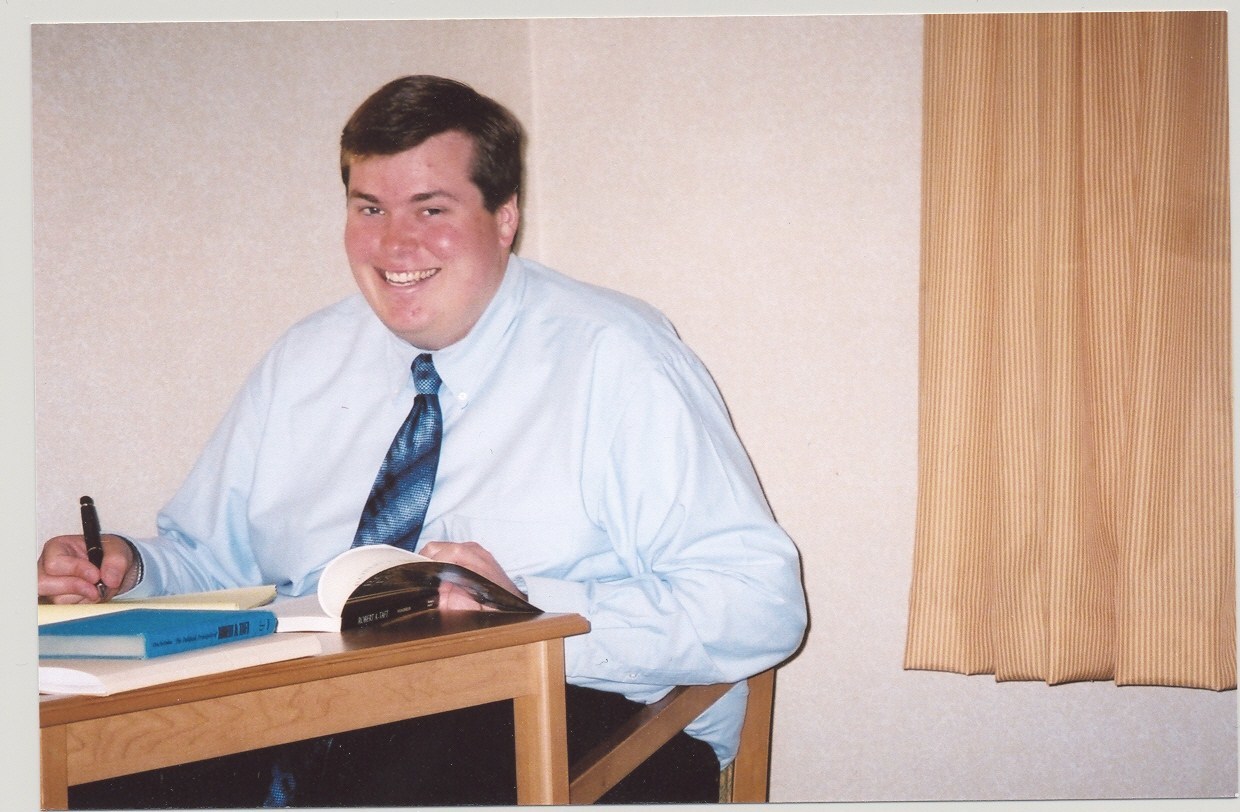

TEF of Iowa policy analyst John Hendrickson. | John Hendrickson

TEF of Iowa policy analyst John Hendrickson. | John Hendrickson

After the Iowa Legislature reconvened following a COVID-19-induced recess, lawmakers wasted no time balancing the budget and supporting two proposed workplace bills but no action was taken on reducing the income tax rate, according to a policy expert.

“We were hoping for income tax rate reductions but because of the COVID-19 pandemic and the resulting economic shutdown both here in Iowa as well as the nation, it was probably prudent not to do any tax rate reduction until we know how revenues will be,” said John Hendrickson, a policy analyst with Tax Education Foundation (TEF) of Iowa. “That was probably a positive thing that it was put on hold for a while.”

As of July 8, 32,622 had Iowans tested positive for the coronavirus and 735 had died, according to the Iowa Department of Public Health.

“COVID-19 brought some revenue uncertainty about how the shut down will impact state revenues and, to a certain extent, we still don't know,” Hendrickson told the Hawkeye Reporter. “This spring we had what's called a revenue estimating conference, which is a three-person panel that projects state revenues, and they revised the fiscal year 2021 estimates. That was the hardest part because of the uncertainty with how to project revenues but they did a very good job with keeping a status quo budget.”

The first workplace bill lawmakers passed was HF 2627 to remove excessive licensing regulation. According to Chris Ingstad, president of Iowans for Tax Relief, removing excessive occupational licensing is helpful because Iowa has more jobs available than it has workers.

“During COVID-19, a number of regulations were waived in order to recognize medical licenses from out of state, for example, and some of the continued education requirements were loosened so if it's good enough to work during a crisis, why shouldn't it be good enough to work all the time,” Ingstad told the Hawkeye Reporter. “Additionally, with so many people impacted by COVID-19 in terms of both employees or workers and businesses with some real hurdles to clear, why have these artificial hurdles in place from the state? Why not remove all the regulations that you reasonably can so individuals and businesses can move forward?”

The second workplace bill lawmakers passed was SF 2338 for COVID-19 liability coverage, which protects health care providers and businesses from frivolous lawsuits.

“We’re in an unprecedented situation with this pandemic,” said Hendrickson in an interview. “As Iowa’s economy is opening up, there’s a need to provide protection for businesses, health care facilities and churches, among other types of organizations, so that there will not be a lawsuit if, for example, someone contracts COVID as a result of going to the grocery store. They can't sue because it's not the grocery store's fault."

The legislation does, however require, businesses and health care providers to follow state and federal standards and best practices, such as CDC guidelines and rules in Gov. Kim Reynolds' proclamation.

“It's meant to provide some protection especially as people return to work and restaurants open,” Hendrickson said. “Iowa has done a very good job so far because we’ve reopened gradually, and the governor has kept a careful watch to ensure that while we reopen, we're also still trying to slow the spread with social distancing.”

Alerts Sign-up

Alerts Sign-up