Iowa Gov. Kim Reynolds | Office of the Governor of Iowa

Iowa Gov. Kim Reynolds | Office of the Governor of Iowa

Iowans for Tax Relief have been an advocate for exactly that. Now, it appears inevitable, with three tax reform proposals under review at the Capitol.

Gov. Kim Reynolds, the Senate and the House of Representatives all have proposals.

The Senate bill, SSB 3074, was advanced by the Senate Ways and Means Subcommittee on Feb. 3.

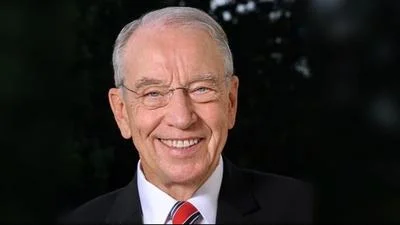

Iowans for Tax Relief President Chris Ingstad

| file photo

The House bill, HSB 626, was recommended for passage by the House Ways and Means Subcommittee on Feb. 2.

Reynolds’ proposal, HSB 551, was assigned to House Ways and Means Subcommittee, while SSB 3044 was assigned to Senate Ways and Means Committee.

Iowans for Tax Relief is registered in support of each of all three bills, the group's President Chris Ingstad said.

“Reynolds’ 4% flat tax would be a tremendous win for the taxpayers of Iowa,” he said. “The Senate bill adds one additional rate cut in year 2027, which is also great. Both the Senate and governor’s proposal includes a reduction in the corporate income tax rate, which would help the business community get relief from some of the highest corporate taxes in the country. All three bills include a complete tax exemption of retirement income.”

Here are the highlights of Reynolds’ plan:

- Establishing a flat 4% individual income tax rate, further reducing individual income tax for all taxpaying Iowans.

- Eliminating retirement income tax.

- Exempting net capital gains on sale of employee-awarded capital stock.

- Reforming Iowa’s corporate income tax.

Victoria Sinclair, government relations director for Iowans for Tax Relief, spoke at Senate and House subcommittee hearings.

“We applaud the governor’s leadership in rolling out a bold plan that significantly reduces income taxes for all Iowans, and we commend House leadership for including her individual income tax reduction proposal within this legislation HSB 626,” Sinclair said at the House hearing, according to Iowans for Tax Relief.

At the Senate subcommittee hearing, she said SSB 3074 “proposes the largest individual income tax cut in Iowa history, and it doesn’t stop there. Not only does this bill offer a flat individual income tax rate of 3.6%; it also provides the first mechanism to our knowledge for eliminating the individual income tax in Iowa. This is an outstanding bill that cuts taxes for every Iowan, and we encourage its advancement.”

In a Feb. 2 Des Moines Register article, Reynolds said everything is on the table in tax cut talks.

“I’ve made the commitment: We’re going to look at all three bills, and we’re going to sit down and see where we end up,” she said during a news conference in Des Moines. “I just believe we’re going to end up in a good place.”

Ingstad agreed with the governor.

“At a minimum, we should see the 4% flat tax proposal adopted as well as movement on the exemption of retirement income,” he said.

Iowa’s state coffers are full, according to a release from the governor's office, allowing lawmakers to propose such cuts. Ingstad said it also is the product of conservative leadership.

“Years of fiscally conservative budgeting coupled with the outstanding leadership shown by Gov. Reynolds in keeping Iowa open for business” brought the Hawkeye State to this point, he said.

“What is most exciting is to think about how much money these bills would leave in the pockets of Iowa taxpayers. A lower 4% flat tax would have a meaningful impact on family budgets across the state. That’s what ITR fights for, and that what is most exciting about this bill.”

Ingstad joined Iowans for Tax Relief in 2012 and served as policy director and vice president prior to becoming president in December 2016.

Before joining the Iowans for Tax Relief team, Ingstad served as vice president of Pearl Management Company, an investment management firm founded by Iowans for Tax Relief’s late founder and longtime chairman, David Stanley. Before that, he worked in corporate finance roles for Allsteel Inc., an operating company of Muscatine-based HNI Corporation.

Ingstad earned a bachelor of arts degree in finance, as well as a master of business administration degree from Saint Ambrose University in Davenport.

Iowans for Tax Relief advocates for lower taxes, less government spending and fewer regulations, and explains why on its website: “So government will get out of your pocket and off your back.”

Alerts Sign-up

Alerts Sign-up