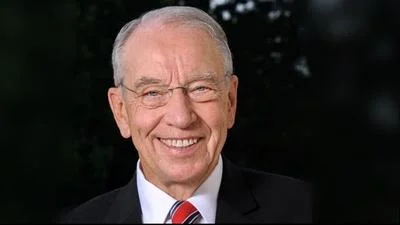

Jennifer Maldonado, director of public affairs, Iowa Credit Union League, left, Sen. Chuck Grassley (R-IA), center, and Sen. Joni Ernst (R-IA) | Iowa Credit Union League / Senate.gov

Jennifer Maldonado, director of public affairs, Iowa Credit Union League, left, Sen. Chuck Grassley (R-IA), center, and Sen. Joni Ernst (R-IA) | Iowa Credit Union League / Senate.gov

The Iowa Credit Union League (ICUL) said that proposed federal credit card regulations "could have a negative impact on credit card security" for customers.

The bill, S. 1838, or the “Credit Card Competition Act” (CCCA, S. 1838), originally sponsored by U.S. Sens. Richard Durbin (D-Ill.) and Roger Marshall (R-Kans.) would require banks to offer merchants at least two network options, one of which cannot be Visa or Mastercard, for processing credit card transactions. Opponents to the bill argue that if given the choice, retailers would likely choose cheaper, less secure networks for processing transactions, thereby exposing consumers to increased securities and fraud risks.

"The CCCA could have a negative impact on credit card security by allowing retailers the option of choosing the network in which they route payments," said Jessica Maldonado, director of public affairs for the ICUL, told Hawkeye Reporter. "Retailers could be incentivized to pick the least costly network, which is not necessarily the most secure network for consumers."

"There is nothing in the CCCA guaranteeing retailers would actually lower consumer prices and from what we saw with debit card interchange, big box retailers will just pocket the savings," Maldonado said. "In the environment where the CFPB is already shrinking margins and reducing revenue of financial institutions, further reduction in interchange revenue would likely result in consumers seeing a change in cost to financial services, like free checking accounts."

"The federal government doesn’t need to be stepping in to regulate credit card interchange and private financial institutions," she said.

The Iowa Bankers Association (IBA) has also said that proposed federal credit card regulations would "raise costs" for consumers and negatively impact credit card rewards and other small business benefits.

The bill applies to credit cards what a similar measure in 2010, often referred to as the “Durbin Amendment,” applied to debit cards. The 2010 measure was a requirement of the “Dodd–Frank Wall Street Reform and Consumer Protection Act.”

A 2014 George Mason University study found that the 2010 “Durbin Amendment” led to a 50% reduction in the number of “fee-free” accounts offered by banks between 2009 and 2013, and doubled average monthly fees on “non-free” current bank accounts.

The study also said the measure resulted in an increase of 1 million "unbanked" Americans in the year after the measure was enacted.

Marli Collier, managing director at Airlines for America (A4A), said the proposed bill could also negatively impact Iowa's travel industry and economic health by threatening access to credit card reward programs.

“Airline credit card rewards play an invaluable role in helping to grow Iowa's travel and tourism industry," Collier told Hawkeye Reporter. "Consumers love their rewards cards because they get great value with them, but the Durbin-Marshall Credit Card Competition Act would threaten credit card rewards programs, undermine jobs and negatively impact economic growth across Missouri. Lawmakers in Congress must consider the negative impact that this legislation will have on the consumers and communities across the country that benefit from airline credit cards.”

A report released last year by Collier's organization said 26,096 visitors used credit card reward points to visit the Hawkeye State in 2022, which supported 342 Missouri jobs and had a total economic impact of $37.6 million. These numbers were compiled via a survey of A4A’s member companies.

Glenn Grossman, the Director of Research at financial advisory firm Cornerstone Advisors, told Federal Newswire earlier this year that the bill could also lead to increased credit card fraud risk.

“If the CCCA were to be approved, the routing of credit card transactions would move from a ‘single pipe’ to ‘multiple pipes’ of data flowing from merchants to issuers,” said Grossman. “Today, card issuers depend on the networks to profile and identify fraud. They see all the transactions on their network and have developed fraud detection capabilities that would not be possible in a fragmented structure the CCCA would create."

Grossman added that Visa has invested billions on fraud detection.

“The investment builds trust and in return consumers use their credit cards,” said Grossman. "Zero liability means something to consumers. With the CCCA, it is possible that promise is gone."

In a report released in July 2023, “The True Impact of Interchange Regulation: How Government Price Controls Increase Consumer Costs and Reduce Security,” Grossman wrote that studies show 79% of consumers choose credit cards as a payment option because of their data security.

Grossman said that, under the legislation, credit card authorizations would be allowed to flow across many “pipes” which would eliminate much of the “fraud fighting value that Visa and MasterCard have implemented.”

The bill would not require new networks to provide fraud detection, Grossman explained.

“It is expected these new networks would rather just route data, not ensure the authorization is legitimate. It is a fraudster’s dream come true!” he said.

Maldonado said the ICUL has reached out to both of Iowa's U.S. Senators to let them know of the group's opposition to the bill, which is currently pending in the U.S. Senate Committee on Banking, Housing, and Urban Affairs.

Alerts Sign-up

Alerts Sign-up